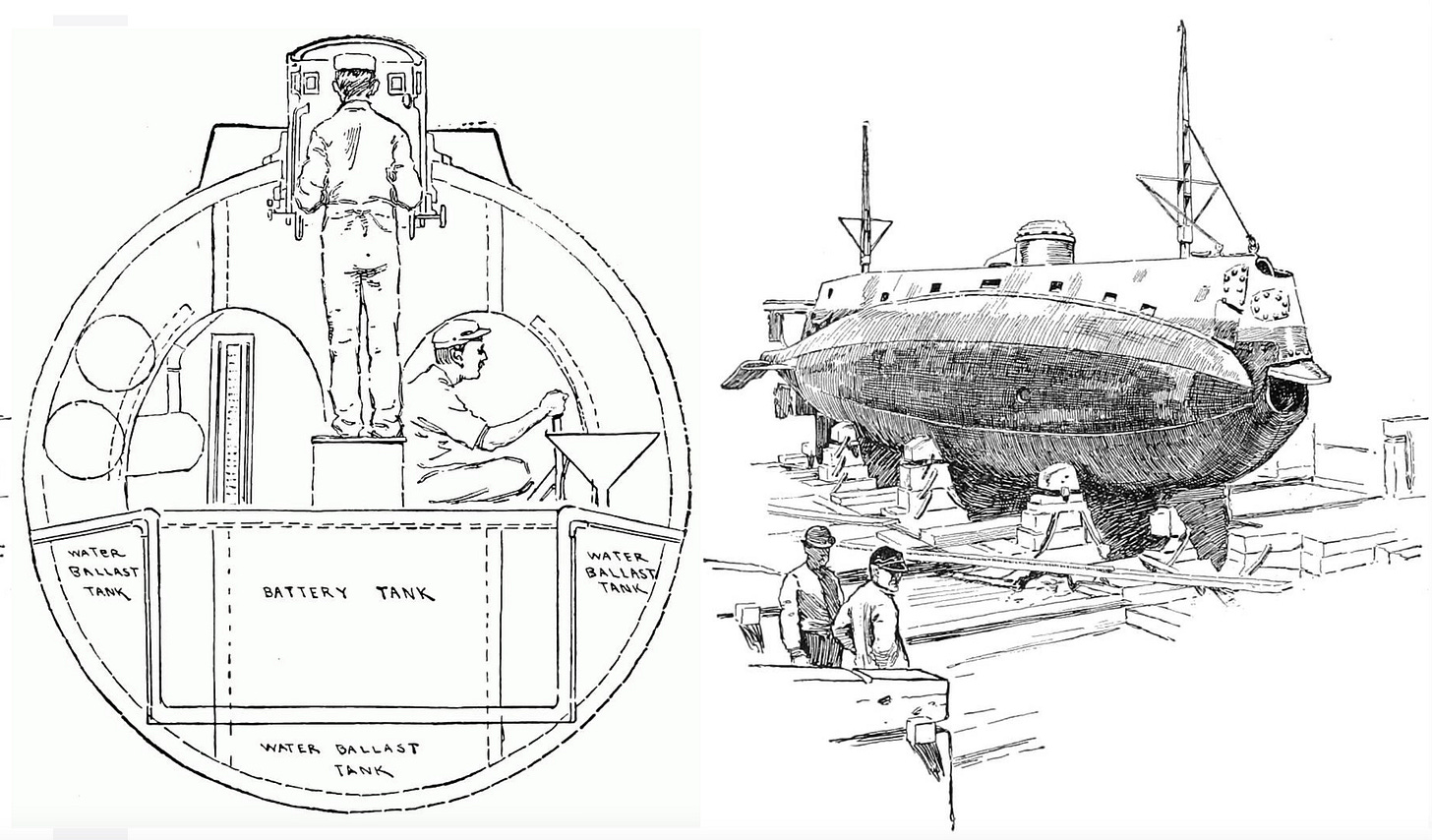

The Fenian Ram sits in a museum in Patterson NJ, an obscure testimony to what would be the opening salvo in subsea warfare. For all practical purposes, it was the world's first submarine. Powered by a kerosene-fueled Brayton Motor, the 30 foot vessel was designed by John Philip Holland in 1881 to allow Irish revolutionaries (of Fenian Brotherhood fame!) to attack British ships along the American east coast in their bid to dislodge Éire from the British Empire. The engineer would eventually be famous, his name gracing a whole class of US submarines, but the forgotten Ram itself holds tight to the two enduring truths of all underwater military vessels:

Tactically, they have always been deployed to subvert the power of a hegemonic surface fleet.

Operationally, they must always confront the general inhospitality of water pressure upon human endeavor at any significant depth (the so-called “spam in the can” issue).

Kraken Robotics (KRKNF, PNG:CA) plays its own role in this enduring saga. A marine technology company based in Newfoundland, Canada, it develops and manufactures devices for underwater exploration. It was founded in 2008 as Kraken Sonar Systems, but through a series of mergers, has dramatically expanded its purview, becoming a leader in un-crewed or autonomous marine robotics, survey sensors, and perhaps most auspiciously subsea batteries.

Though still hovering at only $1.77 a share, KRKNF may finally be entering its own proverbial “sweet spot” year, as navies worldwide scramble for an expanded arsenal of autonomous underwater vessels (AUVs).

These AUVs are far cheaper and more expendable than the submarine --avoiding both the multitudinous ancillary support systems needed to keep crews (the proverbial “spam”) alive as well the larger "political issue" of casualties-- but they depend on the very best in sensors and batteries. Indeed, last Friday’s announcement that Anduril is raising $2.5 billion to “acquire startups and build facilities” might suggest it is looking to roll up Kraken, easily the most mission-critical supplier in its UUV segment.

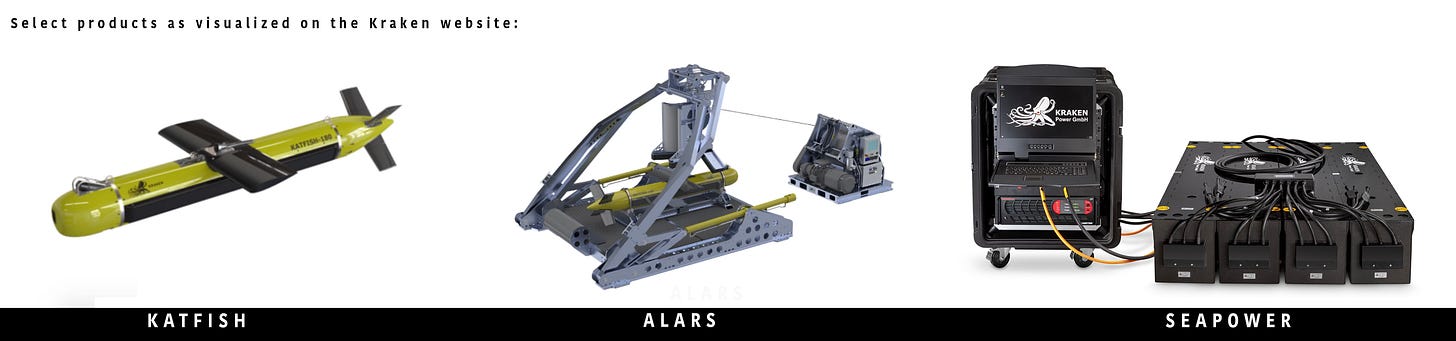

Kraken’s five main product segments are:

ALARS --an "autonomous launch and recovery system" that means UAV vehicles can be deployed and retrieved without human intervention.

Aquapix MINSAS --a miniature interferometric synthetic aperture sonar that can be integrated into various platforms, such as ROVs, AUVs, and USVs.

KATFISH --a towed synthetic aperture sonar system that offers high-res digital imagery of the seabed.

RMDS --Remote mine hunting and disposal system products.

SEAPOWER --a pressure-tolerant battery system to provide energy for UAVs and marine devices for long durations.

The firm's pressure-neutral undersea battery should be of particular interest to investors. Kraken’s unique molding technology enables a battery encapsulation in silicone instead of oil-compensated or titanium pressure housings. Besides being less heavy and less expensive, it is --more importantly-- far less like to corrode underwater. According to the company, its subsea batteries provide up to twice the energy density and weigh 46% less per kWh than traditional pressure-housed batteries. In this regard it has no publicly acknowledged competitors in the West, providing effective battery operation at an ocean depth of 6000 meters.

The design was a decade in the making by Enitech Subsea GmbH, an acquisition rolled up by Kraken in 2017. The technology gives Kraken’s undersea batteries a durable market advantage, providing deeper environment levels and longer durations at sea, precisely at a moment when the recent revelations of naval warfare in the Black Sea have Western militaries clamoring for new strategies, new tactics and a whole new UAV arsenal.

The New Era of XL-UUVs

In many ways, the West is playing catch-up. China has arguably stolen a march on the secular shift from submarines to extra-large un-crewed underwater vessels (XL-UUVs or XL-AUVs). Developing XL-UUVs in secret at its Sanya naval base since at least March 2021, the PRC now has more XL-UUV designs in the water than any other navy.

Last year, Poly Technologies, a Chinese defense company, showcased their “UUV300CB,” a large, multifunctional underwater drone capable of autonomously executing missions such as surface reconnaissance and minelaying with a range of 450 nautical miles. A secondary variant --known as the UUV300CD-- features torpedo launchers on both its port and starboard sides. Both are available for export, suggesting that China is comfortable with AUV proliferation.

This push to build very large UUVs –ones that can replace a sizable portion of a nation's submarine fleet—has grown dramatically over the past three years. In December 2023, Boeing's impressive Orca XLUUV was finally delivered after nearly six years. Last April, retired General Mark Milley suggested a third of the US military will be robotic by 2033, and in September, Chief of Naval Operations Adm. Lisa Franchetti famously publicized Project 33, which has a stated goal of “scaling robotic and autonomous systems across the US fleet by 2027” so that the sea service will be ready for a potential war against China:

“The Chairman of the People’s Republic of China (PRC) has told his forces to be ready for war by 2027 — we will be more ready,” Franchetti wrote. “Project 33 is how we will get more ready players on the field by 2027. Project 33 sets my targets for pushing hard to make strategically meaningful gains in the fastest possible time with the resources we influence."

Project 33 aims to quickly transition "from experimentation to the full operationalization of these systems," moving beyond mere testing to implementing them in real-world missions by 2027. This means that by that year, robotic and autonomous systems will be "routine assets" in every deploying Carrier and Expeditionary Strike Group.

These XL-AUVs or XL-UUVs will be doing everything we expect from traditional crewed nuclear submarines –the ability to surveil, deter, and strike in distant seas without having men on board exposed to danger. (Of course, this raises a thornier ethical issue: because they lack human crews, UUVs are viewed as far more expendable. Their destruction by an enemy may be seen as “less of a red line” crossed, another slippery "grey zone." The lack of norms governing the use of XLUUVs could embolden a foreign nation to strike at them).

At present, XL-UUVs are being developed globally by navies around the world, and include western defense contractors like Boeing, Anduril, Saab AB, Kongsberg, Oceaneering, and BAE Systems.

They are all require big batteries.

Anduril Industries: The Big Kahuna

Anduril Industries is a defense startup affiliated with Palmer Luckey (of Oculus fame) that has caught global attention due to its ambitious focus on the future of autonomous defense and rapid manufacturing. As of August 2024, this private company has a valuation of $14 billion.

It is a major client of Kraken's and is presently constructing a new production facility in Quonset Point, RI to enable the rapid construction of its Dive-LD. This versatile, 3-ton AUV is clad with a 3D-printed exterior and can operate at 6,000 meters of ocean depth. Rumored to cost a mere $2.5 million each, the Dive-LD was put forward for Replicator funding by the Navy’s PMS 394 and was ultimately selected for the second tranche.

The company also received the $18.6 million contract from the US Navy, following its win in a “swim-off competition for a “Large Displacement Unmanned Underwater Vehicles (LDUUV) in late 2023.

The 150,000 sq. ft factory will allow Anduril to complete 200 hulls per year (!) and is expected to open in early 2025. What makes this important for Kraken investors? Every Dive-LD is heavily equipped with Seapower batteries and numerous Kraken sensors and utility software. Anduril’s stated 200 Dive-LD per year (as this factory reaches full capacity perhaps in 2026) should spell an additional $600 million per year in revenue for Kraken. Even assuming a partial ramp of 65 Dive-LDs this year, this one contract provides $130 million to the KRKNK top line in the coming fiscal year.

This US win is not Anduril’s only rodeo: in 2023 the firm unveiled its Ghost Shark XL-AUV prototype for Australia’s navy and the country’s “Advanced Strategic Capabilities Accelerator” consortium.

Under their current $90 million co-development agreement, Anduril is to deliver three Ghost Sharks by June 2025. Australian authorities have said they expect to use a "future fleet" of Ghost Sharks for advance “intelligence, surveillance, reconnaissance, and strike” and will be building the vessel at a Sydney plant. Each Ghost Shark relies heavily on Seapower batteries and sensors.

These two impressive contracts suggest Anduril is cooking with gas. Two press releases in October 2024 suggest how its growth may be affecting Kraken. One announced another $13 million purchase for SeaPowerTM subsea batteries by “existing clients.” The other was Kraken’s "bought deal" public offering to $45M, which brought together a syndicate of investors to purchase 28.13 million shares at a price of $1.60 per share, allowing an expedited capacity build-out.

The dominance of one singular client can be both a worry and a blessing, depending on your line of thinking. If you see the Seapower battery as a commodity, then it is worrisome; if you see it as a “best of breed” mission-critical product with a durable patent after years of development, it becomes far more benign from an investor standpoint. At this point in time, I believe it is an incredible tailwind. (More on this lower down.)

Financials: Very Expensive but Real Growth Potential

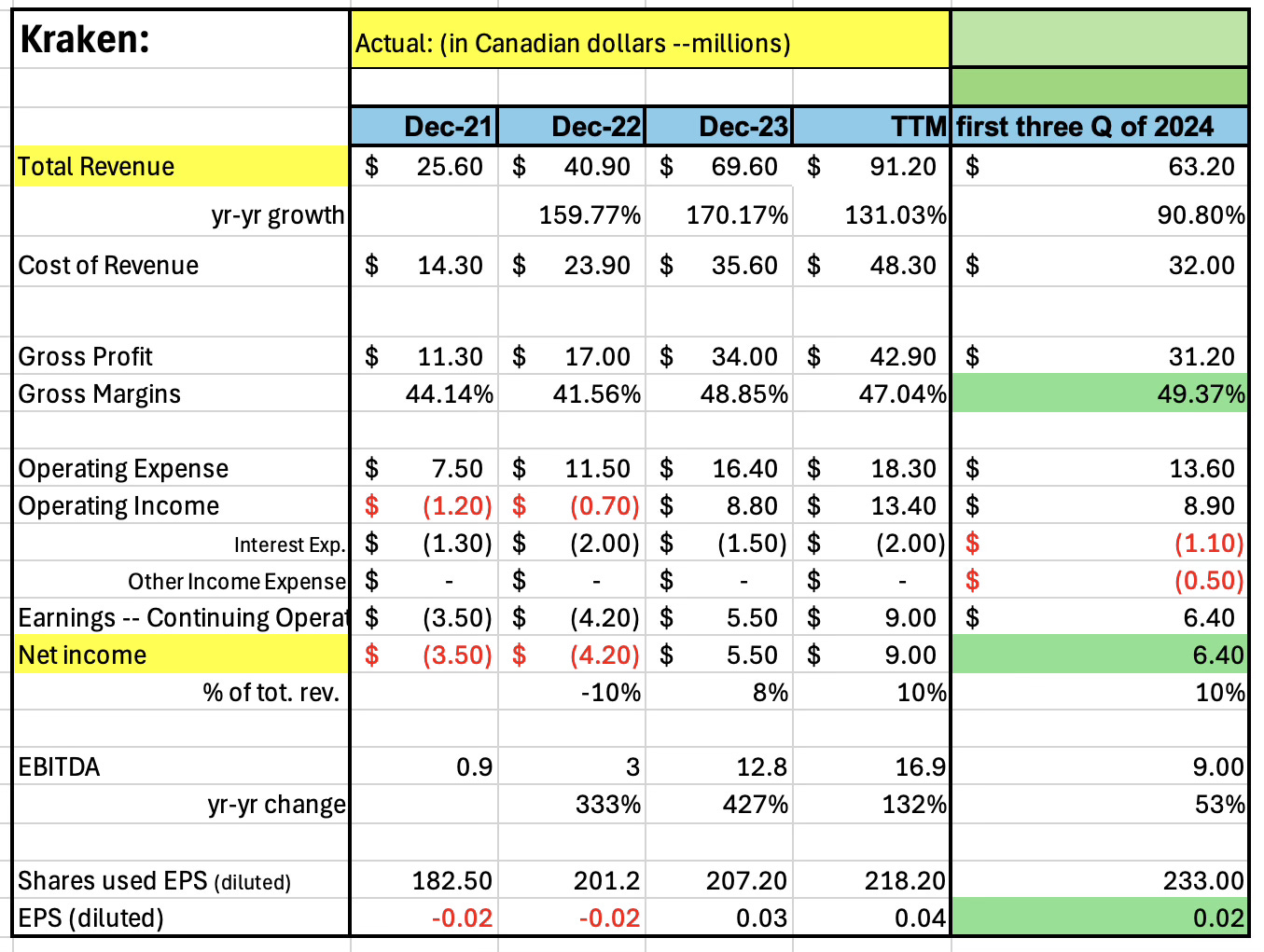

By all traditional metrics, Kraken Robotic is expensive. Its P/S of 5.76 and P/E (GAAP) of 58 are very high, as shares were bid up last year in the wake of several Anduril contract wins and impressive top-line growth.

Their financial position looks strong, however, with short term assets of CA$67.65 million vis a vis liabilities of CA$24.38 million and long term assets of CA$33.53 million versus CA$17.88 million. Technically, the ticker has shown impressive resilience at the US$1.82 support line established since early November, channeling between that and an upper resistance of US$ 2.05. Clearly the market is in a bid-up "wait and see" mode.

Kraken’s last reported quarter was ostensibly a disappointment. Its Q3 revenue of CA$19.55M was -3.9% year-over-year, and its quarterly adjusted EBITDA declined 6% to CA$4.1 million compared to C$4.4 million in the prior year due to its slightly lower revenue. Product revenue in Q3 2024 decreased 27% compared to the comparable quarter, primarily due to lower Katfish and RMDS revenue --according to management-- with subsea power revenue increasing significantly in the quarter.

Net income in the quarter declined 29% (to CA$1.6 million vis a vis CA$2.3 million in Q3 2023) due to higher financing costs relating to the credit facility entered during April 2024. This recent quarter's results muddied things, though the net income growth of 117% may have kept the stock so well-supported in its existing price channel. The fact that management held strong to its annual financial guidance also helped:

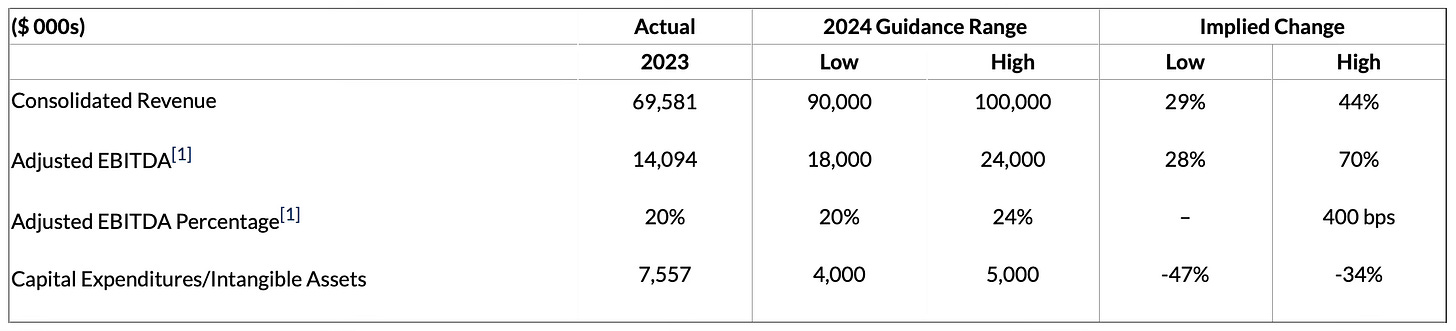

“Our annual revenue and adjusted EBITDA financial guidance remains unchanged. Kraken expects revenue between C$90.0 million to C$100.0 million and Adjusted EBITDA in the C$18.0 million to C$24.0 million range. Capital and intangible asset expenditures in 2024 are now expected to be in the C$4.0 million to C$5.0 million (versus C$6.0 million to C$7.0 million previously)."

As the first three quarters of 2024 have clocked in revenues of CA$ 63.2 million, that full-throated guidance suggests a 4Q top-line number of at least CA$ 26.80 million. That appears quite doable. The first three 2024 quarters nearly match (91%) all of 2023 full year revenues, and the present TTM is CA$ 91.20 million. Gross margins have been tending up over the recent quarters:

Of that estimated CA$90 to 100 million, roughly CA$75 to 80 million is expected to be batteries and sensors, which implies significant growth in 2024 vis a vis $56 million in 2023. Remember the October press release stated CA$13 million in batteries (and CA$3 million in sonar aperture orders).

Management was explicit in its guidance range for the next quarter, also estimating a nice drop-off in capital expenditures:

During the earnings discussion, management pointed to where some of the new product revenue came from year to date: the sale of a Katfish to a navy in the Asia-Pacific region, continued work on large orders received including SeaPower® subsea batteries, the sale of a Katfish system to a NATO country and RMDS to the Government of Canada.

Management also spoke of future demand in the mine warfare segment which I had not been aware of:

In the mine warfare (MW) and critical underwater infrastructure (CUI) arena, navies around the world are in various stages of planning and executing upgrades with multiple large tenders in the market or coming to market in the next one to four years. This year, we have invested significant time and resources on in-field technology demonstrations and naval defense exercises in Europe, Asia Pacific, and North America including exercises such as Minex, Baltops, and RimPac. In September at REPMUS (Robotic Experimentation & Prototyping with Maritime Unmanned Systems) in Portugal, we supported Kraken’s synthetic aperture sonar on UUVs from five allied countries. In October, we held demos for more than 10 navies at the Naval MCM conference in Halifax. Historically, these demos have driven future sales and with our growing track record of success and relationships in this area, we believe we are well positioned to win our fair share of these future large programs.

That Singular Client

Of course the central revenue driver for Kraken will be those stepped-up orders by Anduril.

Of the three Ghost Sharks expected by June 2025, Anduril produced the first one by June 2024, well ahead of schedule. I believe the next two may also come in ahead of schedule, with thus another $15 million for Kraken before 2Q. (Early arrival could even expedite the start of variant Ghost Shark products that the Australian Navy have slated for year-end).

The Ghost Shark program is the crown jewel of Australia's US$4.62 billion investment in subsea warfare capabilities and new autonomous and un-crewed maritime vehicles. The project includes 10 Australian companies partnering with Anduril and 42 others benefitting in the supply chain. It allows for enormous power projection and may keep Chinese naval forces pinned well north of Australia in the South China Sea in the event of a hot war.

In terms of the Dive-DL, Anduril's fully-functioning Quincy facility can presently build 12 per year, and could even increase to 24 with extra shifts.

Announced in June 2024, the Dive-LD Rhode Island factory is expected to open in 2025, with suggestions that it will be a maritime equivalent to its new aeronautical hyper-scale Ohio facility, with a capacity of 200 Dive-LD hulls a year. (Remember the Div-LD have 3D-printed exteriors which expedites its construction and any variable designs!). This new facility is clearly connected to the Power 33 program, and was quickly initiated following Anduril's $18 million contract with the US Navy. In fact, it goes to the heart of the "scale up autonomous systems" mandate of the program, with surface fleets in the near future moving with an outer scrim of expendable AUVs at their vanguard.

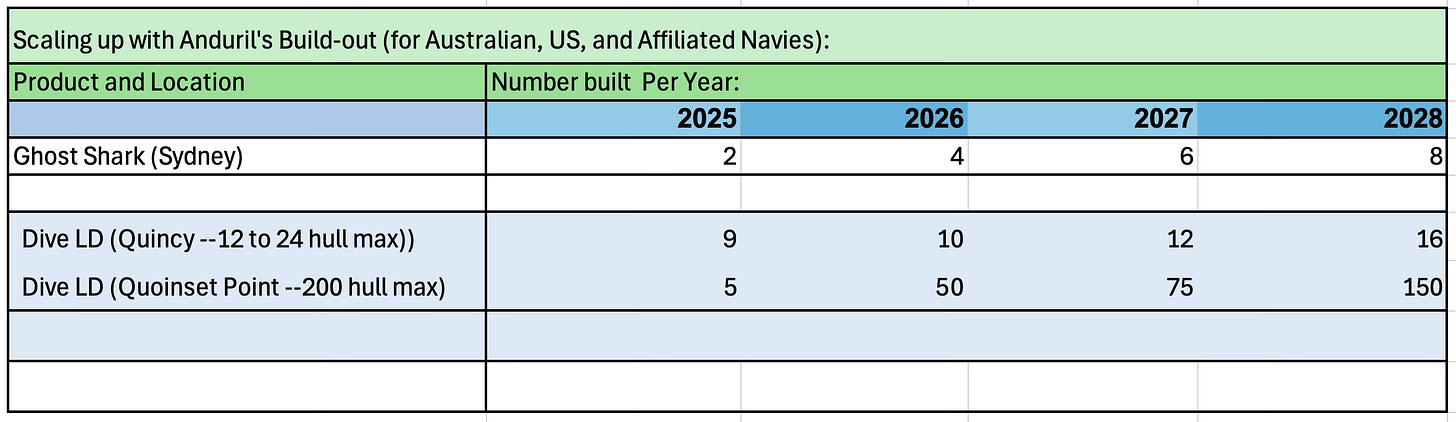

Based on the facility capacity and the stated effort to "catch up" to China by 2027, one can speculate on the "hulls per year" construction for both the Ghost Shark and Dive-DL.

I estimate GS construction could go from 2 in 2025 to 8 in 2028, while the smaller Dive-LD's buildout goes 10x from, say, 14 to 166. This would lead to an extraordinary leap in Kraken's top-line growth. Indeed, in an interview last week, the company's COO Nat Spencer, who heads up the battery division, was explicit about this enormous defense sector demand that has reshaped his segment over the past two years.

In my opinion, Kraken’s “secret sauce” dominance in pressure-neutral battery design makes it an obvious target for Anduril. Kraken’s market cap is only $478.41 million. Buying the supplier would save Anduril $100+ million in battery input costs within just the three to four years alone.

As a disruptive VC-backed startup, acquisitions have been an integral part of Anduril's strategy. They have rolled up several companies to date, the most important being Dive Technologies, the incubator for the Dive-LD, in 2022. The firm has deep pockets to tap when needed. It raised $1.5 billion in funding in late 2023, most of which will go to their new "hyperscale" drone plant in Ohio.

Just yesterday, on February 7, it was announced that the company signed a term sheet to raise up to $2.5 billion at a valuation of $28 billion. This raise is not needed for the Ohio plant nor arguably the Rhode Island facility (construction started in July 2024). Peter Thiel’s Founders Fund is leading the latest Anduril financing, with a $1 billion commitment, so there might be an effort to just "harvest" the present market interest for autonomous systems.

However, Anduril as an entity is ferociously driven: its revenues doubled in 2024 to about $1 billion, with annual contract value reaching $1.5 billion. As suggested by CNBC’s anchor Morgan Brennan, the new raise is “massively over-subscribed” and will go “acquiring startups” and furthering its hyper scale facilities.

Risks:

The risks to Kraken Robotics are myriad. Kraken is already a very expensive stock, priced well beyond its present book of business.

There are many competitive risks. The sonar industry in particular is highly competitive, ranging from small single product companies to diversified defense contractors. Their Katfish product is gaining adherents but that too is filled with able competitors. Their batteries offer a better solution, but could be out-priced --in fact, the Orca XLUUV uses a hybrid system of lithium-ion batteries and diesel generators.

The market assumes the firm will rise, as a supplier, in the slipstream of Anduril's astonishing ascendency. Any change in the relationship with Anduril would be catastrophic to its heady valuation. It could cut the stock in half.

More generally, its revenue from UUV batteries is predicated on a continuance of the mounting geopolitical pressure we see in the Indo-Pacific; if "world peace were to break out," it would not be good for this company. Another political wrinkle: Kraken is a Canadian company, and could experience the full force of US tariffs in March; its Seapower batteries are made in Germany which might also be hit with tariffs in the coming months. This could meaningfully hurt profits going forward.

However, the bull case for Kraken Robotics remains. It is based on the assumption that Anduril and its innovative "hyper-scale" manufacturing platforms (in Sydney, Ohio, and Rhode Island) are what Western navies will use to quickly “level up” their maritime autonomous systems in the face of peer competitors within the next three years.

In colloquial terms: Australia's “Advanced Strategic Capabilities Accelerator,” the DoD’s Replicator, and the Navy’s Project 33 are an operational "Hail Mary."

Kraken Robotics is a small but essential part of that play.

What a great reading, thank you Sean! Being a newbie to investing, I have to ask: how an acquisition by Anduril would play out?